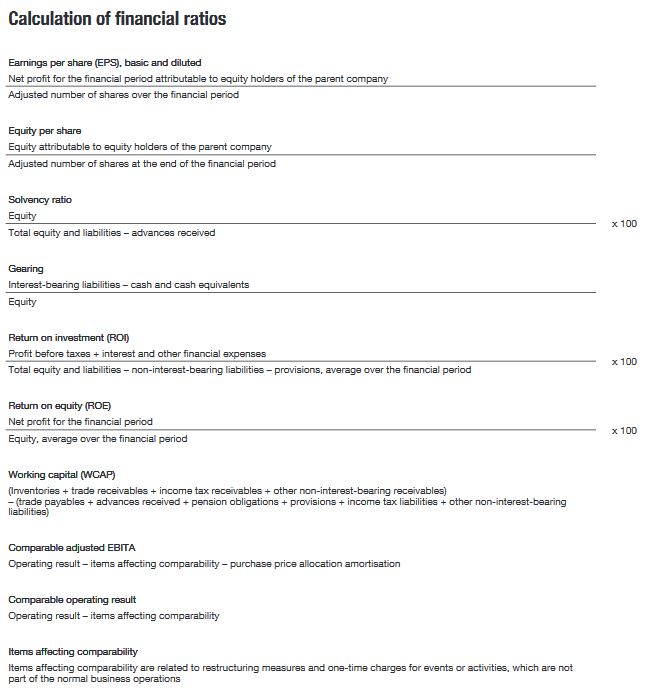

Contents:

ProShare Capital Management LLC is the Trust Sponsor and commodity pool operator . The Sponsor is registered as a CPO with the CFTC, and is a member of the NFA. Neither this ETF nor ProShares Trust II is an investment company regulated under the Investment Company Act of 1940 and neither is afforded its protections. This fund is not an investment company regulated under the Investment Company Act of 1940 and is not afforded its protections. Please read the prospectus carefully before investing. The price of silver in 2030 is difficult to predict, as bullion prices can fluctuate by the second, let alone from year to year.

Note that this policy may change as the SEC manages SEC.gov to ensure that the website performs efficiently and remains available to all users. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website.

The Juanicipio project is a sizable property at 16 km long and 7km wide but only 5% of the property has been explored to date. MAG Silver has an ongoing exploration program in place targeting multiple highly prospective targets across the property. By subscribing to email updates you can expect thoroughly researched perspectives and market commentary on the trends shaping global markets.

Silver Price Live Chart

Needs to review the security of your connection before proceeding. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

The investment seeks to reflect the price of silver owned by the trust less the trust’s expenses and liabilities. The fund is intended to constitute a simple and cost-effective means of making an investment similar to an investment in silver. All investments involve risks, including the loss of principal. Performance data represents past performance and is no guarantee of future results. Investment returns and principal value will fluctuate and are subject to market volatility. Current performance may be lower or higher than the performance data quoted.

Five alternatives to gold

Aberdeen Standard Physical Silver Shares ETF are issued by Aberdeen Standard Silver ETF Trust. The investment objective of the Trust, symbol SIVR, is for the Shares to reflect the performance of the price of silver less the expenses of the Trust’s operations. The Fund seeks to offer investors a simple, cost-efficient https://day-trading.info/ and secure way to access the precious metals market. SIVR is intended to provide investors with a return equivalent to movements in the silver spot price. The stock of Silver can try to reach, or even cross these levels in monthly sessions. The stock can touch or cross these levels during weekly trading sessions.

To buy shares in Vizsla Silver you’ll need a share-dealing account with an online or offline stock broker. Once you have opened your account and transferred funds into it, you’ll be able to search and select shares to buy and sell. You can use Stockopedia’s share research software to help you find the the kinds of shares that suit your investment strategy and objectives.

We adhere to a strict Privacy Policy governing the handling of your information. Credit Suisse was losing the faith of investors long before the SVB debacle. For more information, please see the SEC’s Web Site Privacy and Security Policy.

Verify your identity, personalize the content you receive, or create and administer your account. Barchart is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve our web experience, and encourage users to Contact Us for feedback and accommodation requests. The Barchart Technical Opinion rating is a 24% Buy with a Weakening short term outlook on maintaining the current direction.

- The Sponsor is registered as a CPO with the CFTC, and is a member of the NFA.

- Carefully consider the Fund’s investment objectives, risks, and charges and expenses before investing.

- Analysis of these related ETFs and how they are trading may provide insight to this commodity.

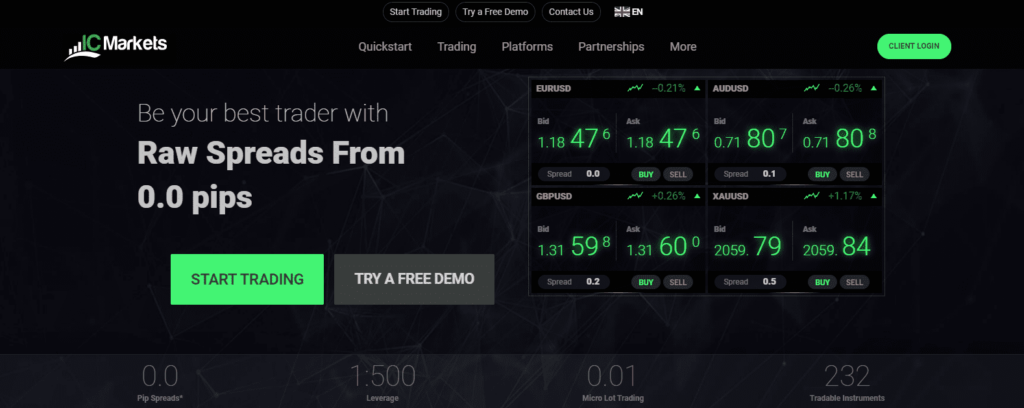

- The most important trading venues for silver are the New York Mercantile Exchange , the Tokyo Commodity Exchange, the Chicago Board of Trade and the London Bullion Market.

- It’s important to understand that the spot price shown above on BullionVault’s chart is provided for reference.

Touch device users, explore by touch or with swipe gestures. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Right-click on the chart to open the Interactive Chart menu.

Silver production in Peru down 20% in January, ministry says

Its subsidiaries include Corporacion First Majestic S.A. Opening an account is free, takes less than a minute, and gives you the ability to begin trading immediately with the free bullion we provide at registration. Spot, in other words, doesn’t necessarily reflect a price you might actually get from any individual bank or dealer, and it cannot reflect the spread between prices to buy and prices to sell. It’s important to understand that the spot price shown above on BullionVault’s chart is provided for reference. Like the spot price published by other sources it represents the average of many wholesale quotes, and – crucially – it represents the average of those quotes’ mid-points.

Realtime quote and/or trades are not sourced from all markets. Sign Up NowGet this delivered to your inbox, and more info about our products and services. We have highlighted five silver ETFs that led the way higher on the short squeeze buzz and could be compelling choices to play the trend in the days ahead. Defiance Silver Corporation trades under the symbol “DEF” on the TSX Venture Exchange, “DNCVF” on the OTCQX, and “D4E” on the Frankfurt Exchange. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Quote data provided by Interactive Data – Real Time Services, Inc. and subject to terms of use.

Page Navigation

However, it’s possible to view historic and real-time prices using BullionVault’s silver price chart above. Looking at the 20-year view, you can see that silver prices reached all-time highs in Dollar, Sterling and Euro in March 2011. The premiums and discounts for funds with significant holdings in international markets may be less accurate due to the different closing times of various how the stock market works international markets. Because the Funds trade during U.S. market hours while the underlying securities may not, the time lapse between the markets can result in differences between the NAV and the trading price. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

Therefore, NAV is used to calculate market returns prior to the listing date. BOSTON — ProShares Ultra Silver was the largest percentage advancer in exchange-traded funds late Monday, adding nearly 9%. The ETF is roughly 200% leveraged to the daily performance of silver prices.

What is the best silver ETF?

- iShares Silver Trust (ARCA:SLV)

- Aberdeen Standard Physical Silver Shares ETF (ARCA:SIVR)

- ProShares Ultra Silver ETF (ARCA:AGQ)

- Invesco DB Silver Fund (ARCA:DBS)

- Global X Silver Miners ETF (ARCA:SIL)

- ETFMG Prime Junior Silver ETF (ARCA:SILJ)

- iShares MSCI Global Silver Miners ETF (BATS:SLVP)

BullionVault is the world’s largest online investment gold, platinum, palladium and silver service, currently taking care of some $3.7 billion for more than 100,000 users. The Daily Price of silver is determined by London’s biggest bullion banks, who agree on a price to clear their outstanding client and inhouse orders at a fixed time each day. The London Bullion Market Association publishes this price on its website.

ETF Details

Certain derivative instruments will subject the fund to counterparty risk and credit risk, which could result in significant losses for the fund. There is no guarantee any ProShares ETF will achieve its investment objective. Expense ratio does not include brokerage commissions and related fees paid by the fund. Open orders are only executed on days when an appropriate price is published. Ordering at the Daily Price is an easy way to buy and sell silver. Tell us how much you want to trade and we’ll do the rest for you.

Until the 20th century silver was more important than gold. Silver is very light in color, can be burnished more easily, and has a higher reflectivity than other precious metals. Silver is a white metal which offers better electrical and thermal conductivity than the other three precious metals. Silver is easy to process and only causes chemical reactions with very few substances, such as sulfur and sulfur derivatives.

You can monitor the silver price today by changing the chart scale above to 10 minutes, 1 hour, 6 hours or 1 day. You can also keep track of the silver price on your iPhone or Android device with the BullionVault App. For private investors, only BullionVault gives you direct access to that trading spread, enabling you to set or accept prices as you choose using our live Order Board. The silver price chart above allows you to select your desired currency from US Dollars, Australian Dollars, Canadian Dollars, Euros, Japanese Yen, Swiss Francs and British Pounds. Credit Suisse AG (”Credit Suisse”) has filed a registration statement with the Securities and Exchange Commission, or SEC, for the offering of securities. Silver has been known since about the 5th millennium B.C.

The actual bullion and cash normally take two working days to settle to your account. For a purchase, your funds stay in your account and are reserved until the bullion is settled. Likewise, for a sale, the bullion you are selling is reserved in your account until you receive the cash, typically after two working days. Yes, BullionVault gives you direct access to wholesale silver, gold, platinum and palladium at live professional-market prices, starting from as little as 1 gram at a time.

Does Sivr pay a dividend?

Dividends. SIVR does not currently pay a dividend.

We give you the fastest silver price updates online, with live data processed about every 10 seconds. This chart also gives you up to 20 years of historical data, so you can see long-term pricing trends. Live and historic data is available in seven different currencies. Performance is shown on a total return basis (i.e., with gross income reinvested, where applicable).

Is SLV backed by physical silver?

The physical silver that SLV participants use to balance the fund with the silver futures price must come from outside Comex registered stocks. It comes from independent vaults or Comex-eligible stocks not registered for delivery against the Comex silver contracts.